Product

AMP (internal dashboard for the sales agency)

AMP design system

Matic agency journey and research

AMP (internal dashboard for the sales agency)

AMP design system

Matic agency journey and research

Product lead of AMP

Engineering team

Director of insurance

Senior designer

Principal product designer

Design lead on the agency tool (AMP)

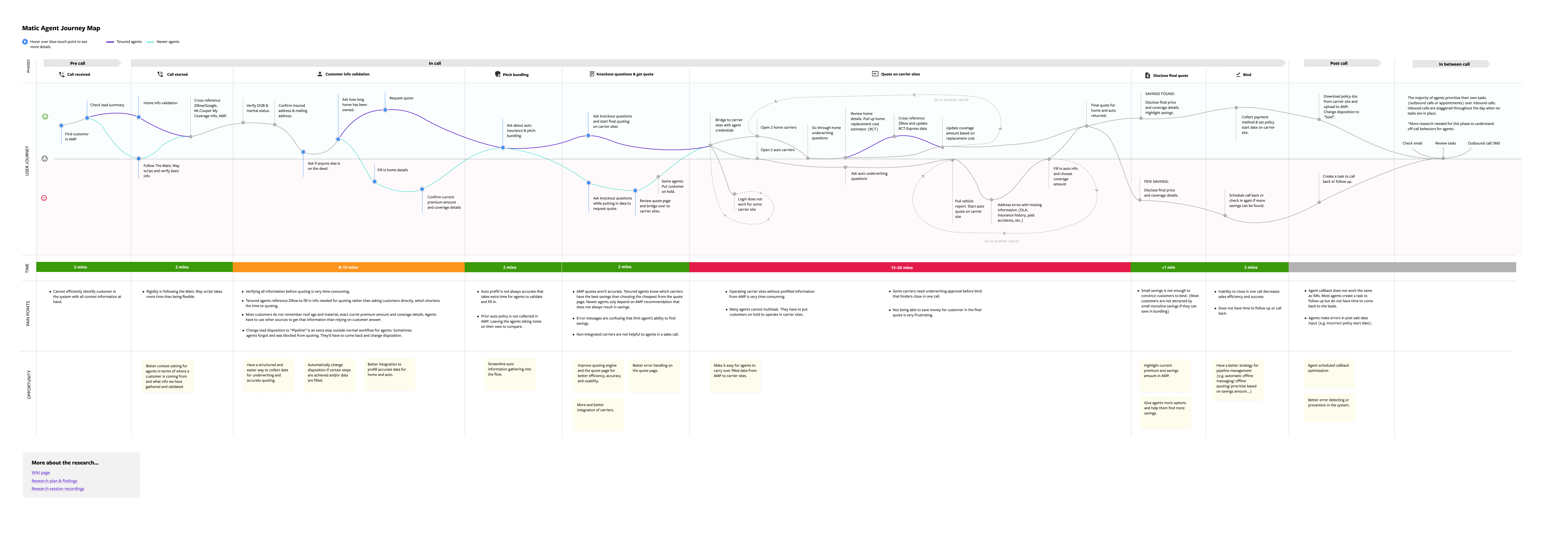

Soon after joining the company, I was tasked to revamp the experience of agency tool (AMP). I initiated a round of user research with surveys, interviews, and sales shadowing sessions to know more about the agency selling experience. At the end of the research, I created a user experience map for Matic agency and mapped out pain points to help product shape their roadmap for the upcoming quarter.

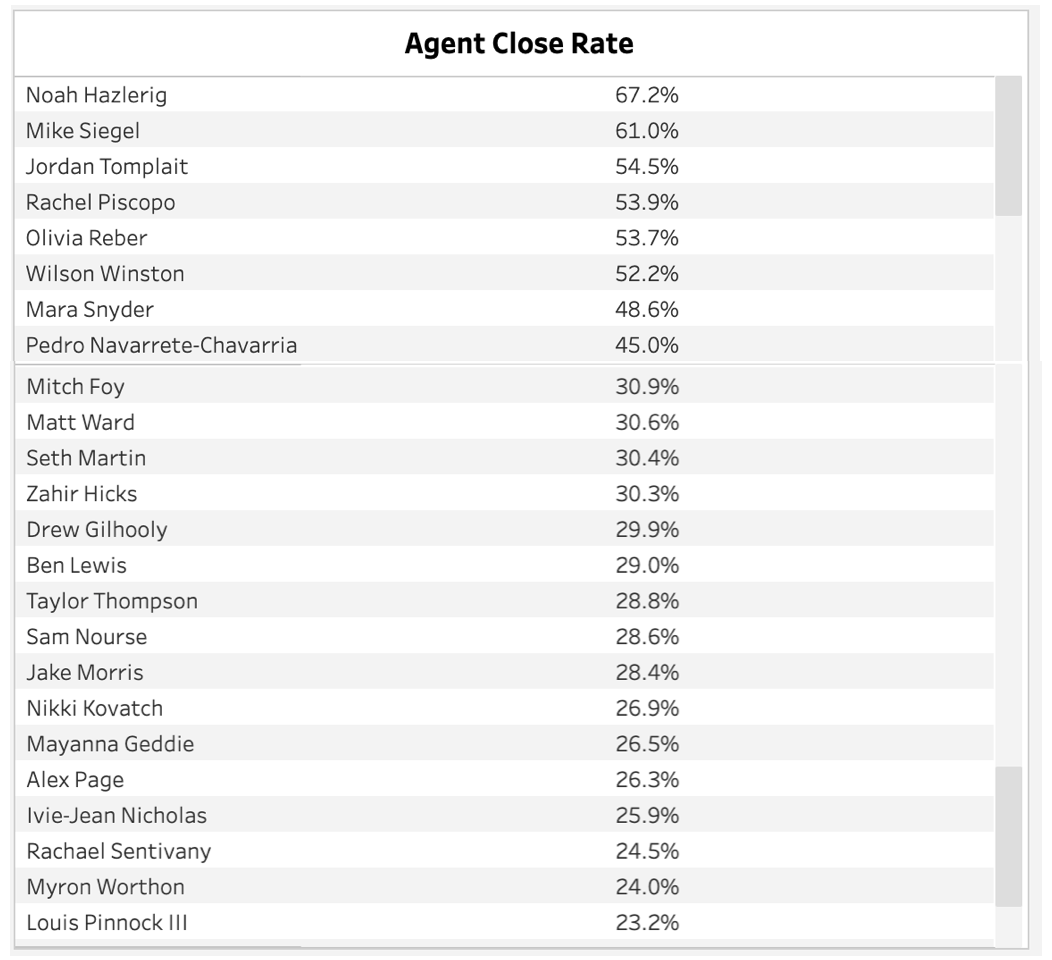

View journeyThe ability to sell insurance is highly dependent on individual experiences from agents. Performance gap between tenured and newer agents creates large churn rate of the agency.

More churns = more newer agents = higher cost of hiring and training = lower sales efficiency & efficacy.

The guided selling experience is a large multi-quarter initiative that fundamentally changes the process by which Matic Agency sells insurance today. We are re-designing the product to guide out agency users through the sales process.

Close performance gap and help agents sell faster and better by building a guided selling experience in the AMP tool. This goal can be broken down to the following sub-goals:

- Reduce time wasted on unqualified leads

- Increase sales efficiency in data collection and quoting

- Help agents upsell more insurance products

Increase transfers of qualified leads

Increase agent sold policies per work hour (PWT)

Increase pipeline close rate

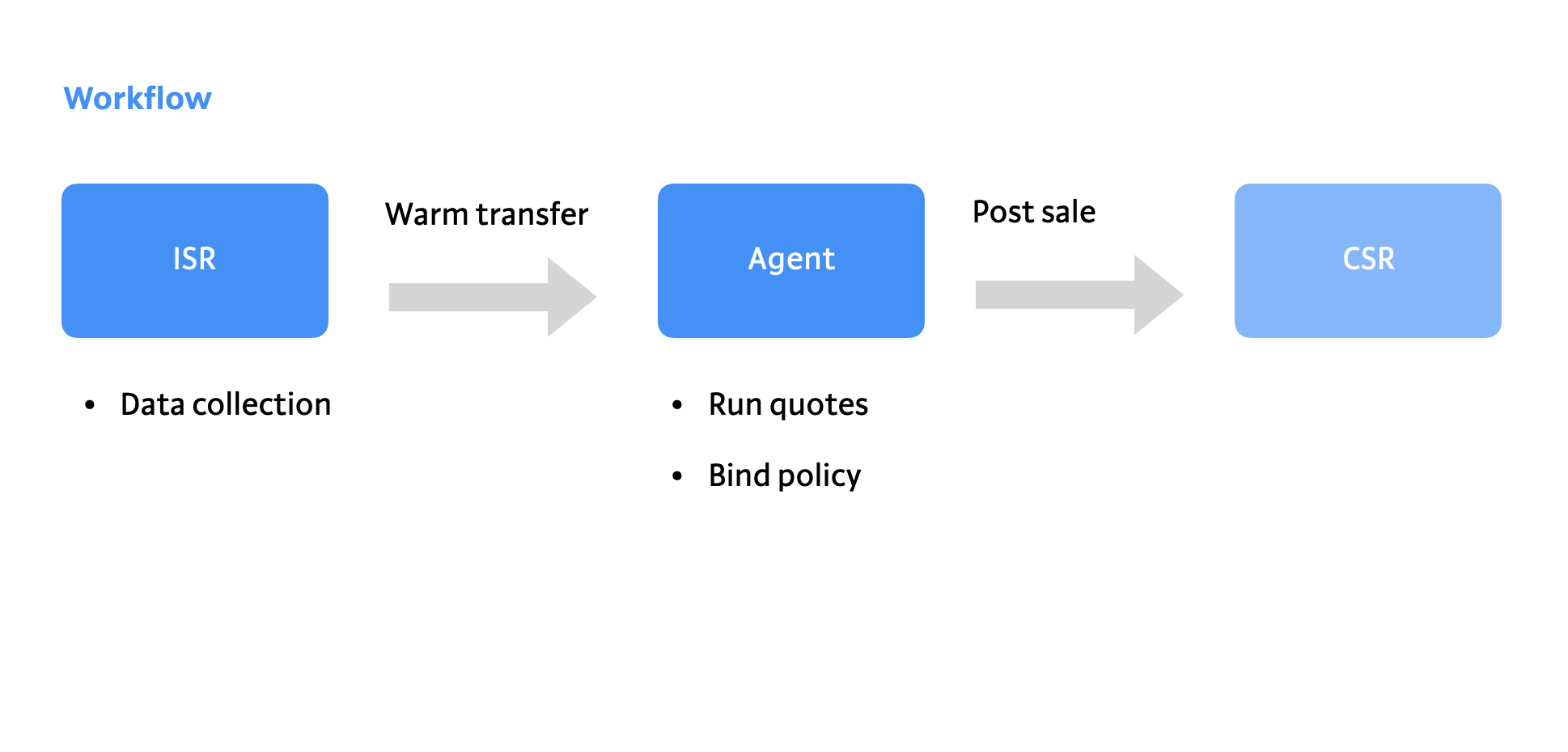

- ISRs (Internal Sales Representative)

- Agents

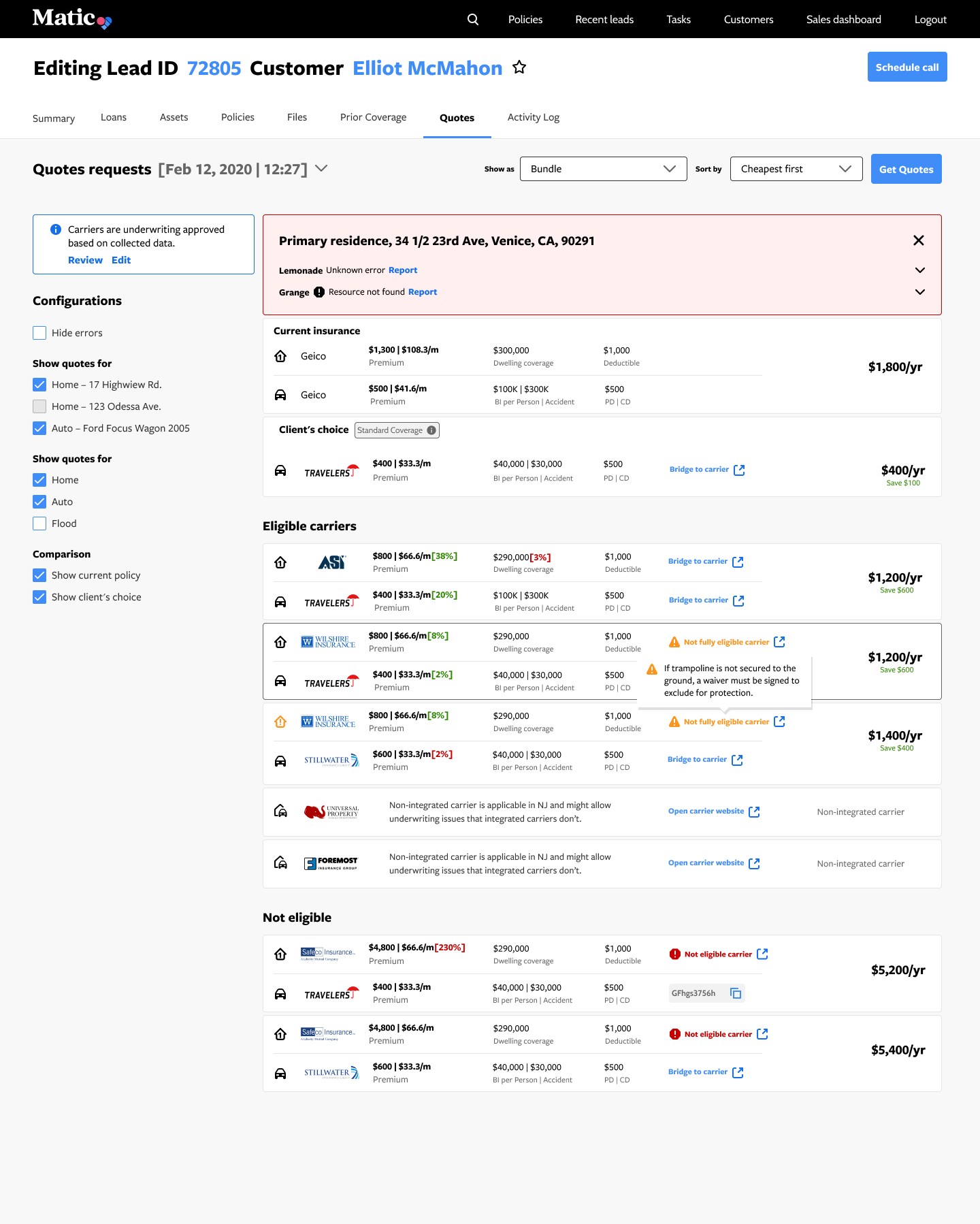

Only 10 out of 30 carriers are fully integrated in the AMP system resulting in long manual data input time on carrier sites.

Auto quotes were inaccurate comparing to home that could impact bundle rate and sales success.

Before

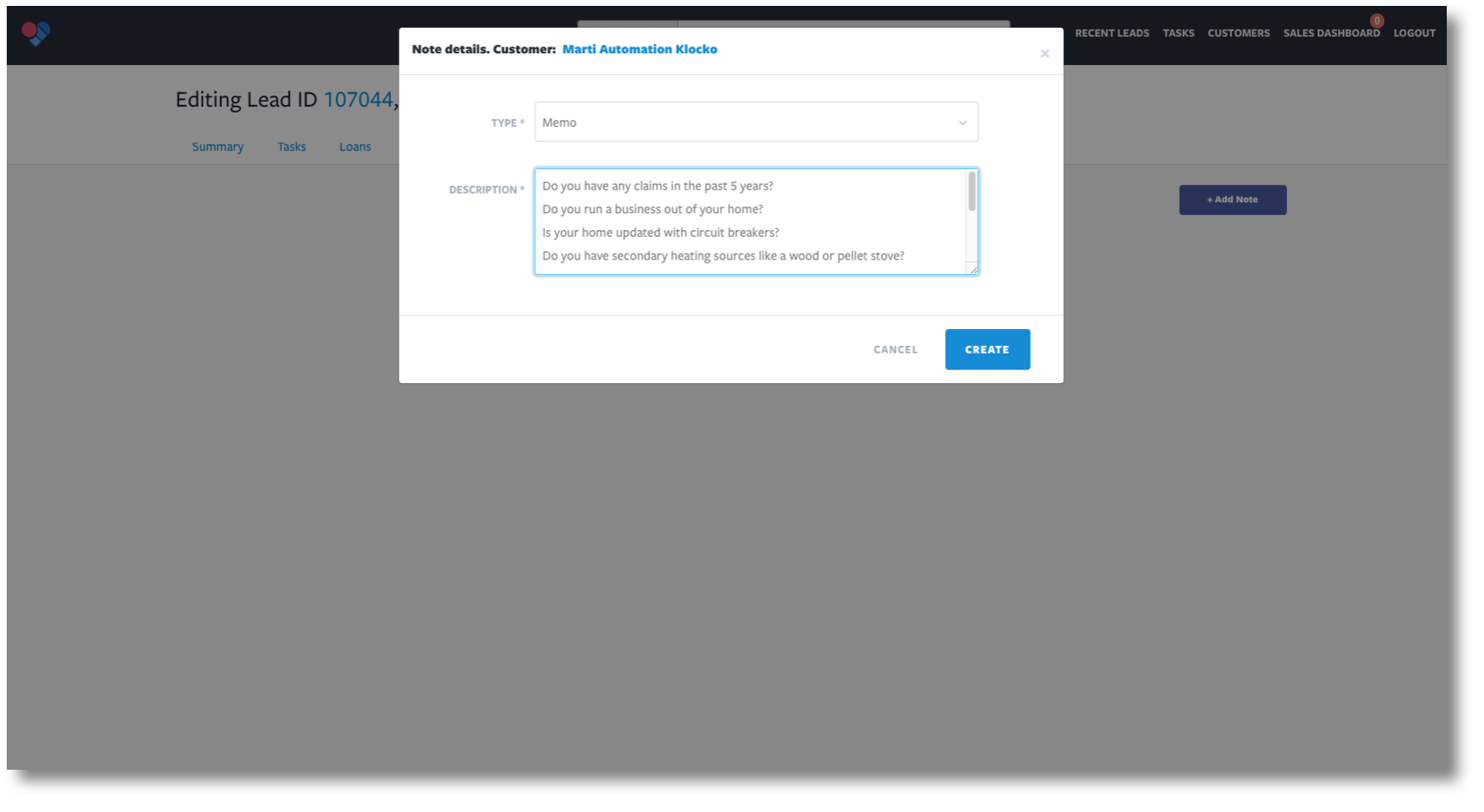

All data were recorded in the Notes section and referenced manually by ISRs and agents.

Lots of time were wasted on unqualified lead when recorded data weren't checked on the system for underwriting.

When a lead gets transferred to an agent, they lost track of what data has been recorded.

After

The linear experience of data collection keeps ISR and agent workflow in one place that saves time and facilitates a smooth hand shake when a lead is transferred from an ISR to an agent.

Recorded data are used for underwriting check to filter out unqualified leads earlier before they get to agent's hands.

Side panel helps agents keep track of what data has been collected.

Left navigation breaks down the process and helps newer ISRs/Agents on track of their workflow.

Before

Tenured agents choose carriers based on their own experience rather than system recommendation to find savings. They don't like to see bundled recommendation.

Newer agents like system recommendation but lacks guidance on what the best option is when the system is inaccurate.

Bridging out of the system to finish quotes in a separate browser tab takes lots of time.

Newly added carriers or insurance lines were stacked at the bottom of the page leading to missed opportunity to upsell.

After

Designing recommended package while allowing customization to drag and drop individual carrier gives the flexibility to build quotes for both tenured and newer agents.

Opening carrier sites inside the system with references to collected data and quotes increases efficiency in quoting and helps agents get to final quote faster.

Easily allow upselling by surfacing additional insurance lines at the top navigation.

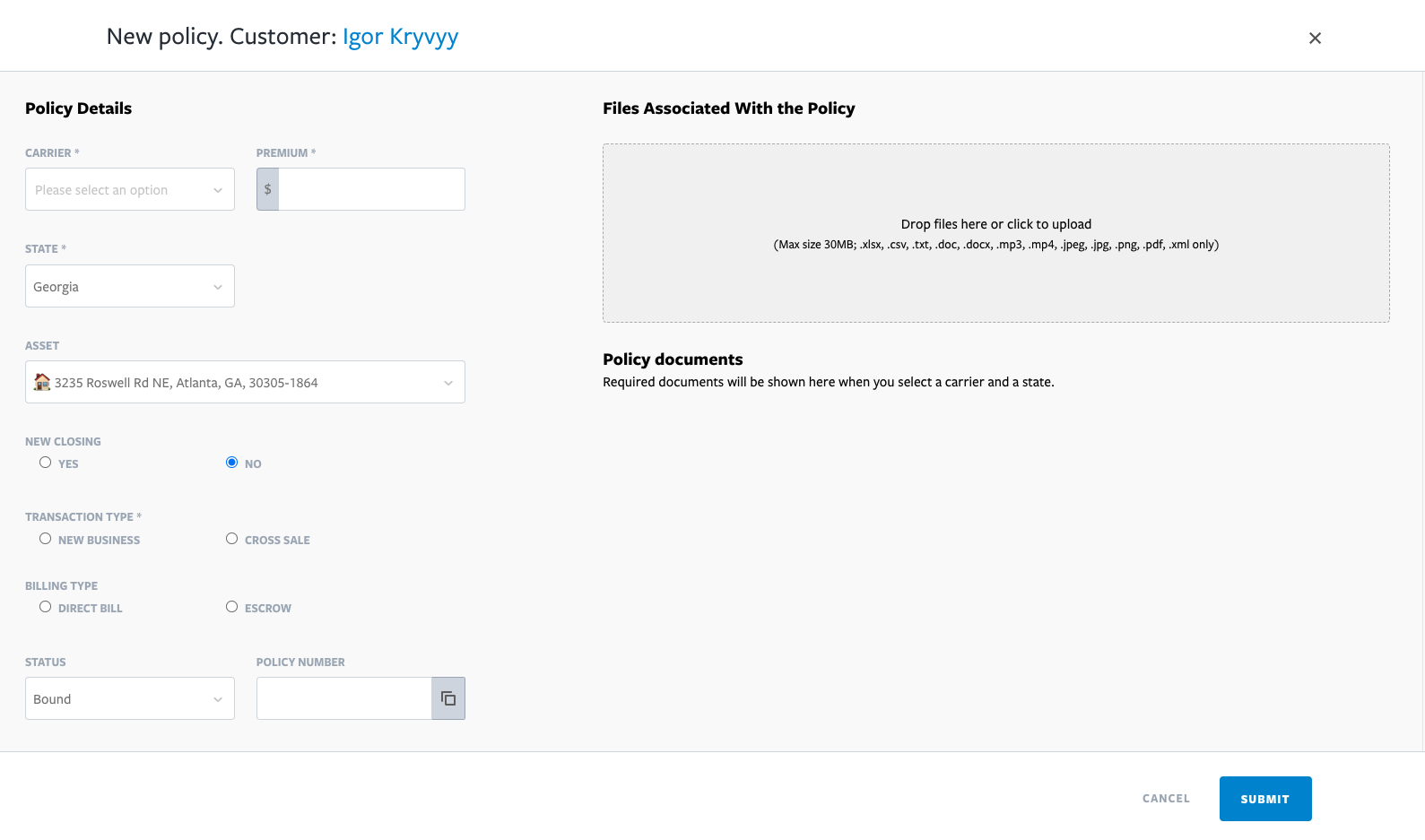

Before

Agents need to reference a separate script document to educate customers on next steps. Jumping back and forth between the script and the system is time consuming.

Data fields and page interaction are not optimized to prevent errors. This leads to customer disatisfaction, policy documentation errors that increases post sale manual reconciliation and customer service workload.

After

Automatic population of data fields based on carrier creates constraints of data input that reduces errors.

A side-by-side view of the post sale script and the policy upload section where each script will generate automatically based on the carrier saves agent’s time in cross referencing the scripts and facilitates a smooth post sale conversation to close the deal.

- Increased # of transfers of qualified leads

- Increased agent policies per work hour (PWT)

Full feature adoption from the agency:

"The Guided Data Collection works really well with the warm transfers from the ISRs. It makes it a lot easier to go through the quote without having to go back and forth on the notes tabs." - Eric, ISR manager

"Super helpful so far! Saves a lot of time going to state by state guide. Will be much easier for the new agents out of training." - Iain, Agent

Copyrights © 2022 - Fan Sun Art, All Rights Reserved.